The Trust Index: Time for a Bounce-Back

I have to tip my hat to Edelman and the firm’s annual “Trust Barometer.” For 11 years, it’s been a foundational piece of thought leadership for the PR profession (frankly, I wish I had thought of it) and they do such a nice job with communicating the results, both positive and negative.

At the FCS breakfast last week, Edelman US CEO Matt Harrington presented the findings as they pertained to financial institutions, and invited comments from panelists from MetLife and Morgan Stanley. This is the second year that Edelman has broken out the findings for financial institutions from the larger, mother study – another smart move.

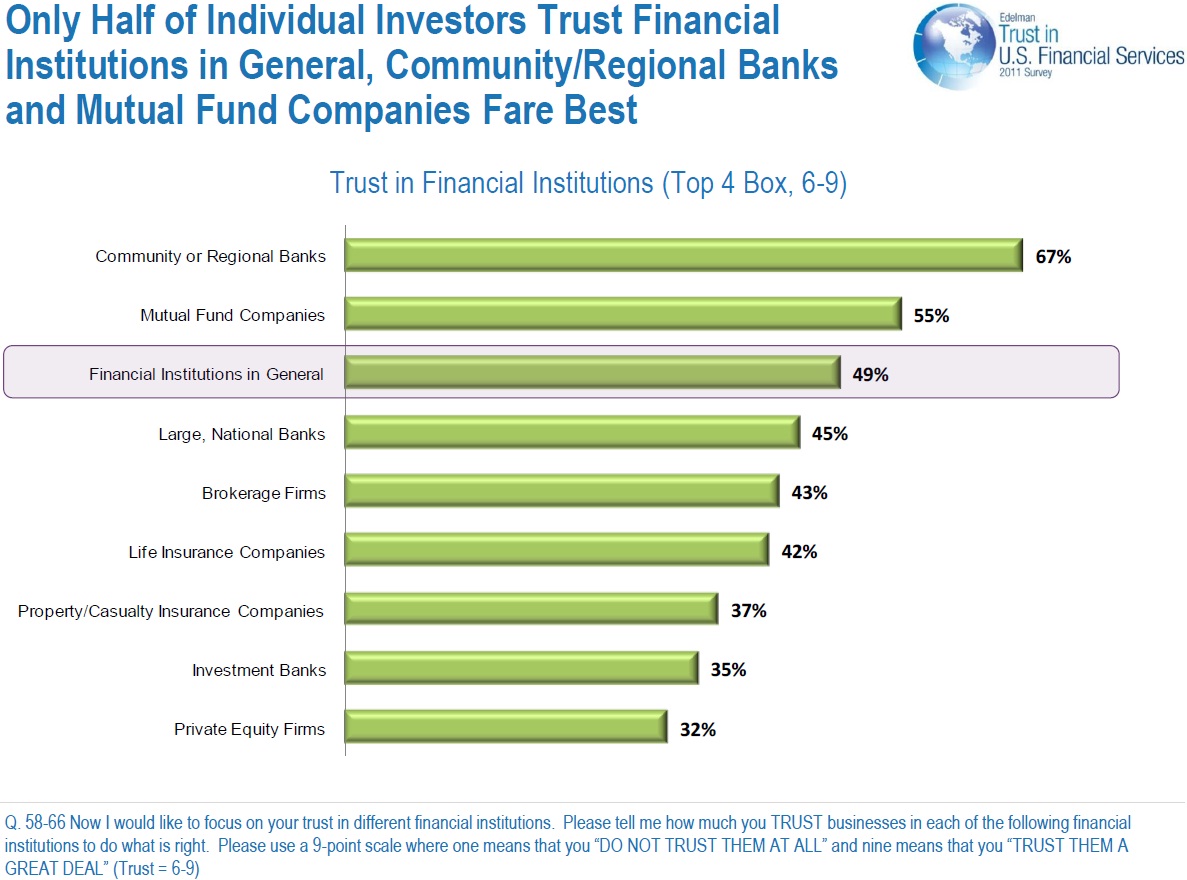

While no one is surprised that the trust numbers dropped to seriously dangerous levels in 2008, and then bounced up a bit in 2009, I know I was surprised to overall trust scores in the US to drop for institutions across the board. And with financial services companies, roughly half of individual investors reported less trust in financial institutions compared to 2009. Perhaps I should not be surprised, given the news: investment banking bonuses back where they were at pre-crash levels, scandals emerging around insider trading and astonishing practices around foreclosure initiation paperwork. It’s not a pretty sight.

Only two categories of financial institution bounce up above the average: community/regional banks, and mutual fund companies. In my opinion, that’s based on two important attributes: familiarity and transparency. Community bankers are the names and faces behind the loans that build up communities and finance small business growth. And mutual funds are the reasonably transparent companies in which we invest our 401(k)s.

At the end of the day, financial services is about money, trust, and contracts. The industry is suffering from a deficit in the one of its core competencies: the trust part. Edelman comes to several important conclusions in its study. The one that speaks most loudly to me is that transparency and honest communications drive corporate reputation. The more our financial institutions can keep these two pillars in mind as they go to market, the more of a “virtuous cycle” they will inspire.

To reach Abby:

Phone: 212.840.0088

Email: abby@blisspr.com

Twitter: @abbycarr

LinkedIn: Abby Carr